Each year, two tax credits are available to help you offset the costs of higher education. You may be eligible to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution. The credits are based on the amount of qualified education expenses paid for the student for the academic year.

Lifetime Learning Tax Credit

The Lifetime Learning tax credit is a non-refundable federal income tax credit of up to $2,000 (20% of the first $10,000) for qualified tuition and related expenses. https://www.irs.gov/credits-deductions/individuals/llc

American Opportunity Credit

The American Opportunity Credit is a refundable credit up to $2500 (100% of the first $2000 and 25% of the next $2000 ) for qualified expenses paid for each eligible student during the taxable year. https://www.irs.gov/credits-deductions/individuals/aotc

In addition to the two tax credits, the student loan interest deduction may be available to you.

Student loan interest deduction

Student loan interest is interest you paid during the year on a qualified student loan. It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (MAGI) amount reaches the annual limit for your filing status.

https://www.irs.gov/taxtopics/tc456

NOTE: These summaries are meant to give a general overview of these educational tax initiatives. Consult a tax advisor or IRS Publication 970 regarding the specifics of your personal situation.

Tax information (Form 1098-T)

What is the 1098-T form?

The 1098-T form will help determine if you are eligible for an education tax credit. It is an annual statement that provides the amount of tuition charged on your account during the calendar year.

If you had qualified education expenses that were billed during the tax year, a 1098-T form should be mailed to you in January for the prior tax year.

If grants and scholarships exceed the qualifying educational expenses for the same year, you will not receive a statement.

College staff cannot provide tax advice. Tax questions should be referred to a tax advisor or the IRS website.

Why didn’t I receive a 1098-T form for the year?

You may not receive a 1098-T. A few of the reasons are:

- You had no eligible tuition charges billed during the year.

- Your grants and scholarships exceeded the “billed” eligible tuition charges for the year.

- You had adjustments (registration and or financial aid) from the prior year that offset the current year’s billed charges.

- For additional information, please refer to the IRS rules.

About Form 1098-T, Tuition Statement | Internal Revenue Service (irs.gov)

Receive your 1098T electronically or print form

Instructions for accessing your 1098-T form

Click on the myBill+payment link (on mySSC under the My Stuff section) and activate your account by signing in and accepting the consents.

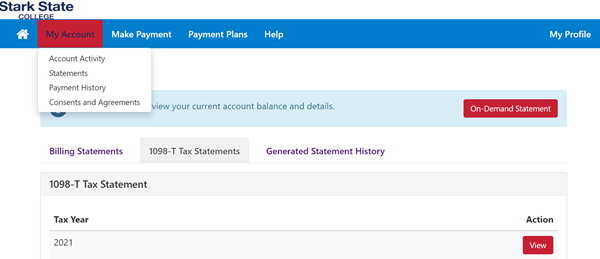

In the myBill+payment portal, click on the My Accounts tab, select Statements and 1098-T. Choose tax year and your form will be available to download for printing.

Questions, contact ECSI at 866-428-1098 or bursar@starkstate.edu